Hourly net pay calculator

As the gross calculator you can calculate it depending on the type of payment a corporate practicesalary or hourly. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year.

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

NHS Hourly Pay 202223 including NI The table below lists the NHS Band salary gross and net hourly rates amount per hour.

. Cost of Living Calculator. Net weekly income Hours of work per week Net hourly wage. Cost of Living Calculator.

The average hourly pay for a Caregiver is 1240. Federal Hourly Paycheck Calculator Results. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999.

Ranges from an average of 1396 to 2447 an hour. AU18 - AU28. Wingubox Payroll provides a more realistic approach based on international best-practice as below.

Below are your federal hourly paycheck results. If you work 40 hours a week then converting your hourly wage into the weekly equivalent is easy as you would simply multiple it by 40 which means adding a zero behind the hourly rate then multiplying that number by 4. This online Salary to Hourly Pay Calculator will translate your weekly monthly or annual salary into its per minute hourly daily weekly and monthly equivalents.

Historically the most common work schedule for employees across the United States is an 8-hour day with 5-days per week. Switch to Massachusetts salary calculator. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

To calculate hourly gross wage multiply the hourly rate and the working hours of the employee. Try paystub maker and get first pay stub for free easily in 1-2-3 steps. For example if you work 8 hours a day 5 days a week that is 40 hours per week.

Plus if you get paid on a salary basis but you are working more than 40 hours per week the calculator will even calculate what your hourly rate would be if you were getting paid. Cost of Living Calculator. Simple loan calculator that works as a mortgage calculator car.

Calculations have been updated to reflect the additional 202223 National Insurance contributions and changes in Pension contributions from October. 45 000 - Taxes - Surtax - CPP - EI 35 57713 year. Calculate your take home pay from hourly wage or salary.

The average hourly pay for a Delivery Driver is AU2290. Visit PayScale to research registered nurse rn hourly pay by city experience skill employer and more. Calculate the 20-year net ROI for US-based colleges.

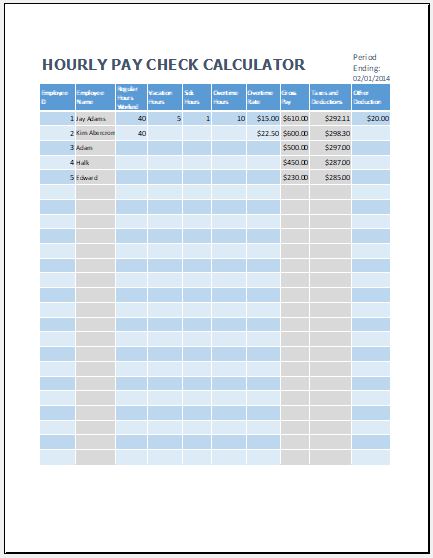

Our salary calculator has been updated with the latest tax rates. Hourly Daily Rate Calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. Skip To The Main Content. Hourly pay at Whole Foods Market Inc.

This calculator uses the 2019 withholding schedules rules and rates IRS Publication 15. The 2022 Weekly Pay Tax Calculator calculates your take home pay based on your Weekly Salary. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual.

Employees can calculate their net pay or take home pay by entering pay period YTD hourly and annual salary rate. Calculate your Weekly take home pay based of your Weekly salary to see full calculations for Pay As You Earn PAYE National Insurance Contributions NICs Employer National Insurance Contributions ENICs Pension Dividend tax etc. Calculate the 20-year net ROI for US-based colleges.

Net annual salary Weeks of work per year Net weekly income. Net pay is the amount left from subtracting the gross wage to the deductions. The average hourly pay for a Registered Nurse RN is 3132.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. It will be the employees take-home pay. Please note that these calculations are based on the 202223 NHS payrise announced in July 2022.

Divide your weekly income by how many hours you typically work in a week. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. Sometimes employees receive overtime pay.

Enter your current payroll information and deductions then enter the hours you expect to work and how much you are paid. You can enter regular overtime and an additional hourly rate if you work a second job. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis.

This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis. Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in your income details. 65000 - Taxes - Surtax - Health Premium - CPP - EI 48 05339 year net 48 05339 52 weeks 92410 week net.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Employment Act 229 Laws of Kenya gives the minimum hourly rate at Monthly Salary225 However this formula acts mainly as a guide and assumes a 52 hour work-week. Switch to salary calculator.

Assumes equal payments after the loan is due if there is a deferement period. The result is your take-home pay or net income. Hourly Paycheck Calculator quickly generates hourly net pay also called take-home pay free for every pay period for hourly employees.

If you work 2000 hours a year. Net weekly income Hours of work per week Net hourly wage. The hourly rate calculator exactly as you see it above is 100 free for you to use.

The results are broken up into three sections. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Use our free check stub maker with calculator to generate pay stubs online instantly.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. New Zealands Best PAYE Calculator. The hourly rate calculator has an option that allows the person to enter a monthly overtime rate at the.

Divide your annual salary by how many hours you work in a year. Online loan calculator to calculate the pay back amount and the total interest to be paid on a loan during its term. Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52 weeks during the year.

Calculate the 20-year net ROI for US-based colleges. Get the hours per week Hours per day x Working daysper week. So if you make 1000 a week that would be 25 per hour.

Real Hourly Wage Calculator To Calculate Work Hour Net Profit

Hours Pay Calculator Sale Online 55 Off Www Wtashows Com

Hourly Payroll Calculator Deals 54 Off Www Wtashows Com

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Hourly Pay Calculator Hot Sale 52 Off Www Wtashows Com

Hourly Paycheck Calculator Cheap Sale 50 Off Www Wtashows Com

Gross Pay And Net Pay What S The Difference Paycheckcity

Monthly Salary Calculator Cheap Sale 57 Off Www Wtashows Com

Paycheck Calculator Take Home Pay Calculator

Take Home Pay Calculator

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Gross Pay And Net Pay What S The Difference Paycheckcity

Annual Income Calculator

Hourly To Salary Calculator

Hourly To Salary What Is My Annual Income

3 Ways To Calculate Your Hourly Rate Wikihow

Paycheck Calculator Take Home Pay Calculator